Independent Contractor Tax Help

If you just started freelancing, your taxes can be tricky to understand. While employers typically carry some of the burden for part-time and full-time staff, it’s different for independent contractors. Even if you have a stable freelancing gig with a company, the tax burden falls completely on your shoulders.

At taxhub, we provide independent contractor tax filing. We’ll find the hidden and unknown deductions that DIY software cant! Filing with a CPA often saves taxpayers hundreds in missed deductions. In addition to filing your year-end tax return we can help with:

Self-Employment Tax

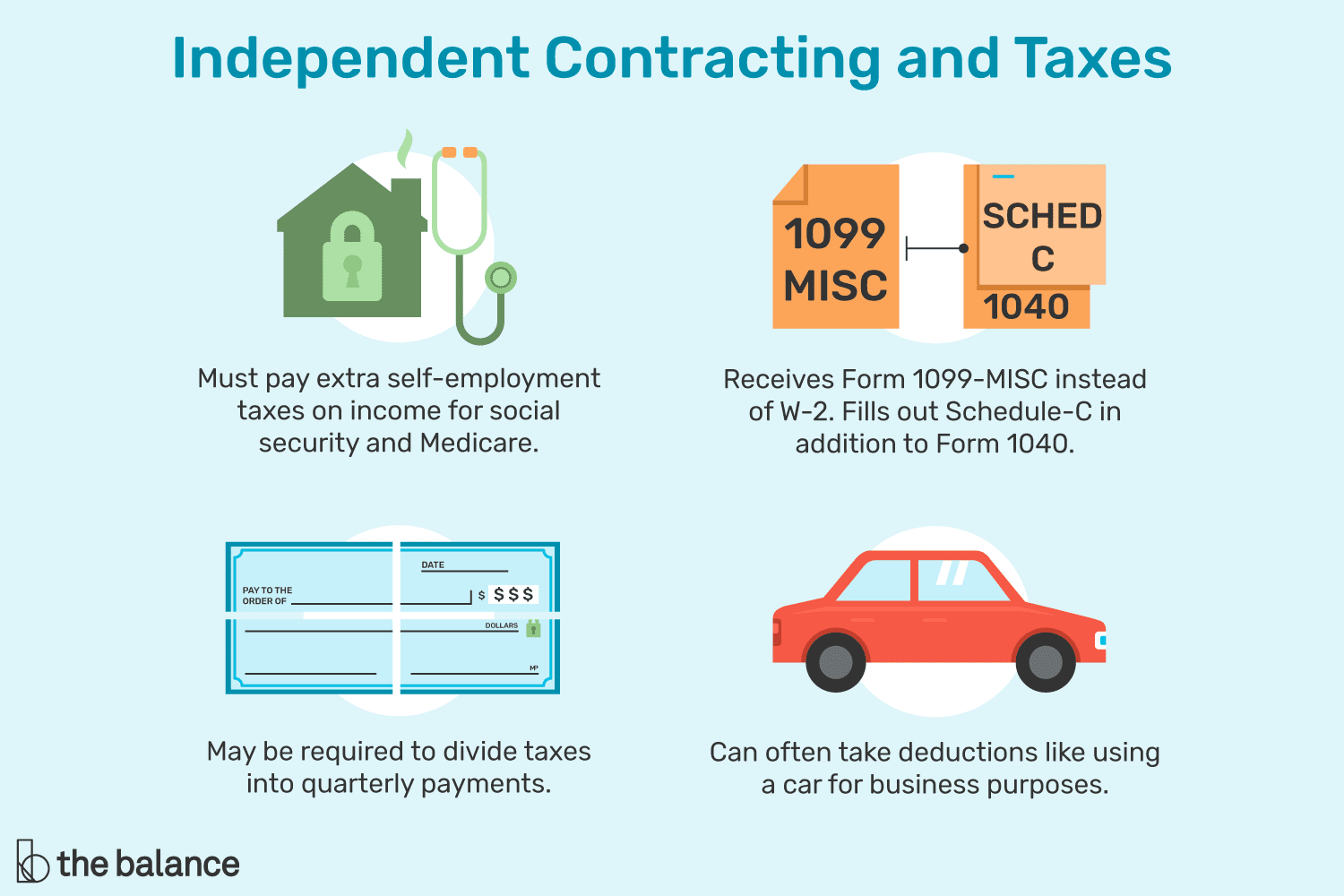

Most people understand you must pay taxes on the money you earn each year—this is your income tax. Additional taxes include Social Security and Medicare. For non-contracted employees, half of these taxes are withheld each paycheck, while the employer pays the other half.

Paying taxes as a freelancer is a bit different. First, without a dedicated employer to withhold taxes for Social Security and Medicare, you have to make up for that somehow. This is where the self-employment tax comes into play. It amounts to approximately 15% of your earnings. This is on top of your income tax.

Essentially, you have to cover both your share and the employer’s share. This surprises many independent contractors when they first start out.

Filing Quarterly

Since you don’t have an employer withholding money for taxes, the amount you owe continues to grow throughout the year. Instead of waiting until tax season to pay it all off, the IRS expects you to take care of these taxes in four installments.

Freelancers often experience an inconsistent income, so independent contractor quarterly taxes are based on estimated earnings. It’s your responsibility to predict how much you’ll earn and to pay the necessary taxes. Calculating this amount comes down to the independent contractor tax bracket you fall into. If you overpay, the IRS will reimburse you in your tax refund. Underpaying, however, typically results in a penalty.

Deductions

Although you may pay more in taxes than you typically do, independent contractors qualify for several deductions. Independent contractor tax write-offs include 100% of your health insurance and any work-related expenses. If your career requires a lot of travel, for example, you can track your mileage and enter this as a deduction.

At taxhub, we can walk you through the process of filing taxes as a freelancer. Our experienced CPAs will help you find your maximum deductions and calculate how much you should pay each quarter. Schedule a free five-minute consultation to get started with our virtual tax assistance services. We can give you the independent contractor tax help you need.