Schedule E Instructions for 2020

Schedule E, also known as the form for your “Supplemental Income and Loss,” is one of the quintessential attachments to your 1040 and is often used by landlords to file a rental property tax return. It is a multi-purpose form that you use to report a few types of passive income for the prior year. Common examples include:

- Rental earnings, often applicable to Air BnB landlords

- Royalties

- K-1 Partnership Income

- Estate Income

Although there are some additional things that you must include, these tend to be the most common items that you show on your Schedule E. Due to the nature of the activities that go on this form, you will often need to add supplemental information via other forms as well. For instance, when you report rental income in Part I, which will be explained shortly, you may have to attach Forms 6198, 8582, 4835, and more. See Schedule E instructions for 2020 below for a detail explanation. Fortunately, albeit a relatively lengthy part of the tax return, most taxpayers only need to report on one or two parts of Schedule E.

Who Needs to File Schedule E?

Schedule E is mandatory for any taxpayer who earned money from renting their real estate, including farm rentals, royalties, partnerships, S corporations, estates, trusts, and real estate mortgage investment conduits (REMICs) interests. Due to the varying nature of each of those line items, Schedule E instructions for 2020 break out the form into five parts where different types of income are reported.

- Part I – used to report income made from real estate activity, except farming rentals, as well as royalty earnings.

- Part II – used to report income from partnership and S corporation activity.

- Part III – used to report income from trusts and estates.

- Part IV – used to report REMICs interest.

- Part V – used to add farm rental income and summarize everything else on the entire form.

You should also keep in mind that, given how Schedule E instructions for 2020 pertains to supplemental and passive income is generally nature, there are going to be a lot of strict and complex loss limitation rules. For example, if you are reporting a loss on your rental activity, the likelihood that you will qualify to deduct it against active income is extremely low. To understand the ins and outs of each caveat, however, refer to the forthcoming guidelines on how to fill out each of the five parts.

How To Fill Out Schedule E

The first thing that you will do when you start filling out your Schedule E is determine which one of the aforementioned five types of income do you have. The reason why you should do this beforehand is so that you can gather the necessary paperwork to fill out an accurate return. For instance, if you are a property owner who rented during the year, you may need to fill out accompanying forms or add receipts to prove your deductions.

Also, depending on how large your businesses were, you might have to include a copy of all 1099 independent contractor forms that you issued to your workers. After that, it is time to get into the numbers for your rental activity earnings. Finally, Schedule E for 2020 is going to be the same for all taxpayers as it does not have a short or “EZ” alternative like some other forms.

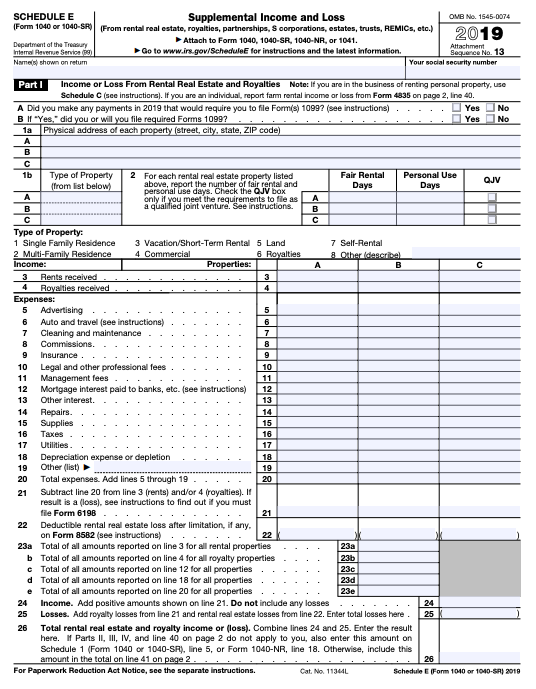

Part I – Income or Loss from Rental Activity and Royalties

STEP 1: To start filling out Part I, first go through the lines 1a and 1b and describe all the properties that you used to generate income during the year. Since each Schedule E comes with three lines on this part of the form, you may need to add multiple schedules to account for the entirety of your rental income. After writing down every property, you will use line 2 to allocate between personal and business-related days of use.

The reason why the Internal Revenue Service, or the IRS, makes you complete this allocation is to ensure that you do not take out more expenses than you should. For example, if you used the property for six months and rented it out for six months, you will only get to claim 50% of overhead deductions.

Line 3 is one of the most important lines on this part as it showcases the total income that you made for each of the three properties. Similarly, line 4 is where your royalty income per property will go. After you completed those two, you have effectively reported the cash inflows of your passive rentals, and now is the time to focus on the outflows.

STEP 2: Lines 5 through 20 are used to deduct a wide variety of expenses that include anything from your advertising and maintenance costs to depreciation or depletion and taxes paid. If you had an expenditure that is not shown here, use line 19 to write in the cost.

Ultimately, you must put together your inflows and outflows on lines 21, 22, 24, and 25. Going through these four lines is probably going to be the most challenging part as it pertains to your loss limitation. In the end, the ultimate income or loss from rental activity and royalties combined will go on line 26.

– Rental Deductions

Given that the number of people who report rental income has increased, especially since businesses like Air BnB have emerged, a lot of taxpayers have questions regarding the deductions that they can take.

Tip 1: In order to maximize the benefits from the expenses that you incurred on your property, the first thing that you should do is create an outstanding data retention system where you store all of your receipts.

Tip 2: Do not forget about the miscellaneous expenses that may not necessarily have a separate line item on Schedule E. For instance, although all Air BnB landlords have to pay fees to utilize the platform, none of them have access to a special line for reporting this number. Instead, it has to be entered as an “other” expense on line 19 that carries an attachment to showcase the details of the expenditure.

Tip 3: Since a lot of online platforms withhold income from property owners, you should follow up with the company that you use to book your rentals. For instance, Air BnB will withhold a certain percentage of income from those who do not provide their tax-related information. If this happened in your case, you would have something to fall back on as a prepayment that the IRS will use to reduce your overall tax liability. Thus, one of the most important things that you can do is your due diligence when it comes to platform-based withholdings.

Tip 4: Do not forget to make proper allocations to your expenditures. If your property was utilized as a rental for only a part of the year and you spent some time using it yourself, you can only deduct a percentage of expenses. If you have a beach house that you rent for three months and use yourself for a month, only 75% of the expenses can be claimed against rental income. Similarly, if you rent out one room in the house in which you live, you can only deduct overhead expenses that are allocated to that particular room. The calculation is generally made based on square footage.

– Rules About Rental Losses

STEP 3: Since real estate rentals represent a passive activity, you will only be allowed to combine the losses with other passive earnings from renting. So, if you end up losing $1,000 on one property, you cannot take that number directly to your Form 1040 and reduce the amount of taxable income. Instead, you will either (1) reduce the income from other rental properties by $1,000 or (2) suspend that loss indefinitely and wait until you have future rental income that you can subtract it from.

The only exception to this will apply to real estate dealers who make a full-time living off of renting properties. In their case, given that they are actively involved with the venture, the IRS will permit a deduction against all other types of income of up to $25,000 that gets phased out by 50% of the adjusted gross income, or AGI, that exceeds $100,000. For instance, if you have a $10,000 active loss from real estate and your Adjusted Gross income is $110,000, you will only get to deduct $5,000. For a much more complex explanation of this topic this see IRS official Schedule E instructions for 2020 at IRS.gov.

Part II – Income or Loss from Partnerships and S Corporations

Lines 27 through 32 are used to report income from your ties to partnership interests or stocks owed in S corporations.

STEP 1: Report the partnership-related numbers, to do this you should refer to the K-1 form that the entity issued to you for 2018. So, start by filling out line 28 with the names of all partnerships and S corporations that you were involved with.

Afterward, enter the appropriate passive or nonpassive income or loss as well as limitations on lines A through D, ensuring that they match lines A through D from above where you reported each entity’s name and identification number.

– Loss Limitations

STEP 2: Figuring out your allowed loss can get quite challenging here as well, especially for partnerships. In cases of S corporations, you deduct up to the amount of the stock basis. So, if your stock basis was $1,000, the most that you could write off would be $1,000. Partnerships, on the other hand, have two types of bases as well as the overarching passive activity limitations.

STEP 2(a): You have to look at your “regular” basis that is also known as the outside basis. If it is large enough to cover the 2018 loss, you will proceed to the at-risk analysis. STEP 2(b): Compare your loss to the inside basis, which is known as the at-risk basis. The reason why it is “at-risk” is because it accounts for all contributions that you made to the partnership that could be taken by the debtors who come after the entity.

STEP 3: If your loss is under the at-risk basis, you will proceed to the overall passive activity limitation (as explained part II step 3). In other words, you will look for other types of passive income to offset or carry the number forward until you earn enough passive income in the upcoming years.

Part III and IV – Income or Loss from Trusts, Estates, and REMICs

Parts III and IV are relatively simple when compared to the previous sections. The incomes and losses for your estates and trusts are reported on line 33, which is also where you enter the entity’s name and identification number. The REMICs income or loss for residual holders will go on Part IV where you only need to fill out lines 38 and 39. In addition to those two, however, you will need to attach Schedule Q as supporting documentation for the REMICs earnings or losses.

Part V – Combine Everything

The only other type of income that you have not accounted for at this point is net farm rental income or loss. It is originally calculated by filling out Form 4835, but you also need to include it in Part V, line 40 of Schedule E. This is where you will combine every other income or loss from the previous four sections by adding lines 26, 32, 37, 39, and 40 together. After you do so, you arrive at the final amount that is reportable for your supplemental earnings, and you must transfer it to line 5 of your 1040 Schedule 1.

Due to the complexity of the loss limitations that apply to practically every part, it is fair to say that Schedule E is one of the most challenging tax forms that you will have to fill out. While the IRS Schedule E instructions for 2020 are a great starting point, you should always consider working with a qualified professional in case this form goes above your area of expertise. Doing so would save you considerable fees and penalties that you might be liable for when the IRS identifies a mistake. Get a free consultation, or get upfront pricing on our virtual tax prep services, now.

Comments