Start-to-finish tax filing, securing every dollar you’re due

Complex filer

Landlords, Multi-state, K1 Income, International

Self-employed

Schedule C, S-Corp, Bookkeeping

Business owners

C-Corp, Partnership, S-Corp

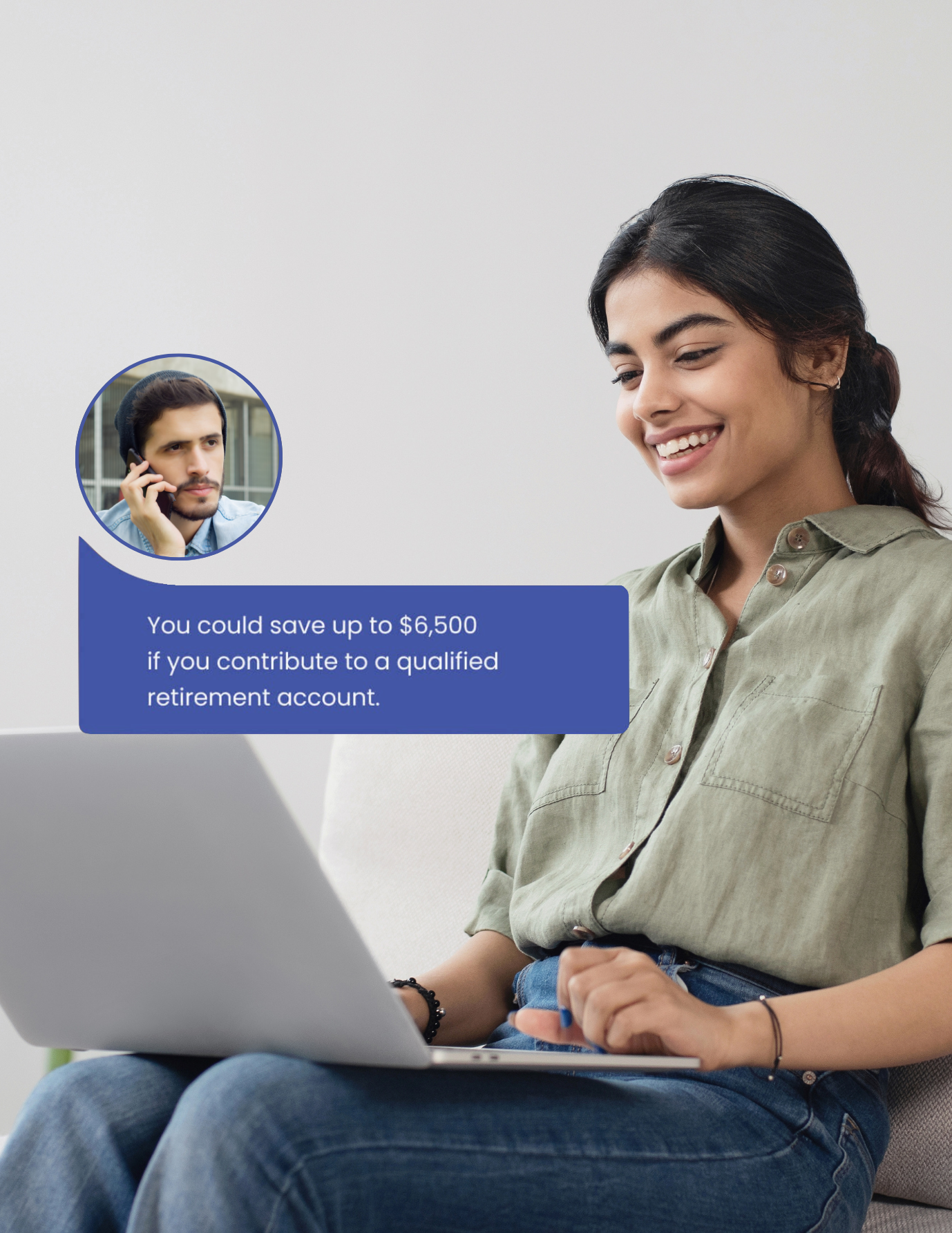

Tax filing is personal. We get it. Now your person is one click away.

- The same CPA year after year AND:

- Scaled pricing for best value

- Maximum savings guarantee

- Year round complimentary CPA access

See why our clients come back year after year

April 24, 2024

via

Google Review

April 24, 2024

via

Google Review

“If I could give 10 – I would give 10 stars! This is all what you need! Quick, great and professional service for your tax refund! Highly recommend to keep in touch with Claudio from Taxhub! He is a real Rockstar! Year after year will use their service! Only the best words for Claudio and whole Taxhub company! 💪 Thanks guys!”

April 17, 2024

via

Google Review

April 17, 2024

via

Google Review

“You guys are wonderful, very professional, efficient, and knowledgeable. I was able to be seen quickly and they resolved my issues very quickly. Thank you!”

April 14, 2024

via

Google Review

April 14, 2024

via

Google Review

“Tax Hub has been our trusted tax agent for over two years now, and we couldn’t be more satisfied with their services. Their prompt responses to urgent requests and diligent adherence to deadlines are truly commendable. Highly recommended for their professional and reliable service!”

February 28, 2024

via

Google Review

February 28, 2024

via

Google Review

“I used taxhub to file my taxes for the 2022 tax year. They helped me organize all of the multiple streams of income so I could be sure I was filing everything correctly. Provided a lot of piece of mind. Thanks Taxhub.”

3 years ago

via

Google Review

3 years ago

via

Google Review

“The process was quick and easy. Great communication. Would recommend for anyone needing help with processing their taxes, especially small business owners.”

April 22, 2022

via

Google Review

April 22, 2022

via

Google Review

“These guys always deliver and help me get everything done even when I contact them last minute and they manage to get me e-filed on time”

April 14, 2022

via

Google Review

April 14, 2022

via

Google Review

I’ve used TaxHub as my tax filing service for the last three years. The team is very responsive, fast at filing, and super easy to work with. Highly recommend TaxHub to anyone looking for a tax filing service!

March 28, 2022

via

Google Review

March 28, 2022

via

Google Review

TaxHub was very professional and affordable too. I’m happy that I found them because they were able to filing my taxes seamlessly even with me living in two different states in the tax year. Looking forward to using them next year and passing along their name for others to use too. Had a great experience with filing my taxes this year. Thanks for all the help!

March 23, 2022

via

Google Review

March 23, 2022

via

Google Review

“Taxhub online tax preparation service is incredibly simple even for complex situations! Great value for a good price! I wish I know about their service before!”

February 24, 2022

via

Google Review

February 24, 2022

via

Google Review

“Taxhub is the most affordable professional tax filing service I’ve come across. My first experience with them was also the smoothest tax filing I’ve had in years. Just upload your docs, schedule a short call, and you’re done. The convenience was unmatched. I highly recommend them and plan on using them again next year.”

April 15, 2021

via

Facebook Review

April 15, 2021

via

Facebook Review

“Excellent service. Have worked eight em for years and highly recommend!”

March 18, 2021

via

Facebook Review

March 18, 2021

via

Facebook Review

“TaxHub provided great service and helped make the tax filing process as painless as possible. My CPA was lightning quick and proactively helped me think through my filing based on my situation. Highly recommend.”

October 9, 2020

via

Google Review

October 9, 2020

via

Google Review

“I had a question concerning my tax situation and decided to give taxhub a shot, and very glad I did. They knew exactly how to handle my foreign tax situation and speedily contacted me at my earliest convenience and got it taken care of.”

August 8, 2020

via

Google Review

August 8, 2020

via

Google Review

“Really enjoyed the quick painless experience with George. I’m from a foreign country and I knew nothing about the tax process and he made the process extremely clear and straight forward. I Highly recommend them.”

July 13, 2020

via

Google Review

July 13, 2020

via

Google Review

“Filing taxes was way easier this year when I switched to Taxhub. Everything done virtually and accountant was patient when I took months to get my documents to them. Pricing was upfront and fair. Would definitely use again.”

March 26, 2020

via

Google Review

March 26, 2020

via

Google Review

“Professional and quick, came to them again.”

October 19, 2019

via

Facebook Review

October 19, 2019

via

Facebook Review

“5 Stars ⭐️⭐️⭐️⭐️⭐️ I had such a great experience with TaxHub! George was really professional and got all my documents completed as requested. He kept in touch throughout the whole thing and I felt really taken care of. It was really helpful for me since I waited till the last minute to file. Thanks George! Y’all are awesome!! 👍 I highly recommend using them if you need a CPA’s assistance!”

August 22, 2019

via

Facebook Review

August 22, 2019

via

Facebook Review

“I am very pleased with the service I received from Taxhub. I would definitely do business with them again.”

April 9, 2019

via

Facebook Review

April 9, 2019

via

Facebook Review

“This is my 3rd year using Taxhub to complete my taxes. I’ve been extremely impressed with the process and results. The site is very easy to use, and I’ve saved a significant amount of time traveling and waiting in an office to meet an accountant. It is a dream service for me! George is also extremely knowledgeable and helpful during the entire process. I highly recommend the service to save time, frustration and to have a great outcome for the year! Thank you George and Taxhub!”

4 easy steps

-

1

Welcome call

Get matched with the best CPA expert for your needs

-

2

Securely share your docs

Safely and easily upload all of your tax information

-

3

Approve, sign and pay

Sign your return and pay for our services after your return is filed

-

4

Year-round CPA access

Reach out for support or with questions anytime throughout the year.

Frequently asked questions

We believe in À La Carte up front pricing based on the number of forms we prepare for you. You can calculate your total cost on our pricing page. No Monthly Fees. No hidden state fees. No “bait and switch” up-charges like some other big name virtual tax prep companies.

The short answer is it depends on your unique tax situation. Just know we have you covered and our CPA’s will analyze your unique tax situation and recommend the optimal tax structure for you in the current and in future years.

The biggest obstacle to filing the S-Corp tax return (1120S) is having a complete income statement and balance sheet (if required). If you do your own bookkeeping, great, we will take your financial statements, if you need us to do bookkeeping we can help you with that as well. If you want to keep it simple and just fill in an income statement template yourself we can provide a template and guide you on what is deductible to your business.

If you have one or several brokerage accounts, are a casual trader or meet the IRS definition of a “Day Trader” you will need year-end brokerage statements detailing the results of your trades. Depending on your classification, you will be required to pay taxes, capital gains or possibly ordinary income. Regardless, we have you covered and can handle anything from casual traders or active day traders.

Get free guidance

Need help? Schedule a free 5-minute call. We’ll help you determine which forms you need and give you a guaranteed price. The consult is free and there’s no pressure to work with us.

BOOK A FREE 5 MIN CALL