Your Complete 10-Step Guide to Creating a SaaS Business Plan!

It’s no surprise that today, businesses that have strong, well-thought out online presences thrive.

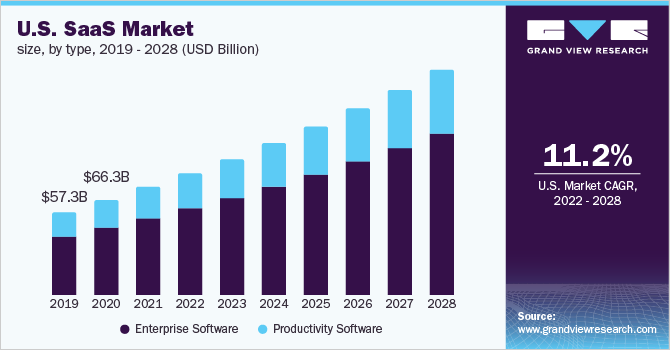

Of the spaces in online business, one of the fastest and most robustly growing is the Software as a Service (SaaS) segment. The global SaaS Market was valued at US$ 143.77 billion in 2021, and by 2028 is expected to reach US $ 720. 44 billion. So if you are thinking of getting into this space, or are already in it, you are making the right decision.

The first step to starting, is creating a resilient, robust but flexible business plan to share with prospective investors. This can be overwhelming, but FinModelLabs has the answer for you.

We have put together a clear, straightforward structure gathered from years of successful meetings and pitches with investors and venture capital firms. By having a cogent and strong business plan, your chances for success will rise significantly.

Let’s get started, and walk through our 10-section SaaS business plan.

SaaS Business Plan Template

Here is the outline below. It also serves as our table of contents. Again, we encourage you to follow this structure when crafting your SaaS business plan:

- Executive Summary

- Identifying the Problem

- Asserting Your Solution

- Outlining Market Opportunity

- The Competitive Landscape

- Business Model Examination

- Marketing Plan and Strategy

- Timeline and Map

- Your Team

- Financial Plan

1. Executive Summary

This is the introduction to your business plan, and in a sense, it is the most important section as these are the first words your audience will encounter. In some cases, certain investors will only have time enough to read this section, so it is worth distilling your vision into this, as a strong and articulate representation of your business plan.

Very important: your executive summary should not exceed 2 pages, maximum.

Just as quality is important, so is conciseness and precision. Devote this section to answering the following questions (which you will expand on anyway later in the business plan, but place your highlights here):

- What problem are you solving?

- What is the solution you’re offering?

- What have been your successes so far (subscriptions, traffic, revenues)?

- Who is your team (especially co-founders) and what are your relevant experiences to this field?

- What amount are you asking for and in what form (investment capital, grants, etc.)?

2. Identifying the Problem

This is your ‘why’. What drew you to what you’re doing; explain what you are trying to solve in this section.

Pro tip: putting it simply isn’t better, it’s best. If you think about big business successes, many are addressing everyday problems of necessity, which aren’t necessarily at the front of mind. For example, if your SaaS addresses accounting software inefficiencies and recurring problems, emphasize that here. While not everyone may be familiar with accounting specifics, investors and seasoned parties will know a problem that needs addressing.

Preferably, alongside the problem, you would also list two or three specific pain points you would aim to address through your business. For example: your SaaS would address both current inefficiencies in the accounting system, as well as handle the problem of educating future and incoming staff on how to use this, in an accelerated way.

3. Asserting Your Solution

In this section, discuss how your product/service/start-up benefits your consumers and target market. You can discuss your theory of change briefly, but rather than enumerating this in detail, try to bring up and answer the pain points you mentioned in the previous section.

Doing so will not only build continuity and flow to your business plan, but it will also hammer home the clear and undeniable value that your business brings to potential customers. By contrasting concrete pain points and solutions, you prove that your idea is valuable.

4. Outlining Market Opportunity

This is where you discuss who your product will be servicing.

To do this effectively, there are two main factors you’ll need to address: i) market size (how big is your market, in terms of monetary value); and ii) market growth (how fast does your market grow?)

To do this, you will need to conduct some market research: look at multiple sources of information, such as publicly available research reports, business articles, trade journals, etc. In their publicly available annual reports, public companies publish market information as well – in their own analysis sections, which at times includes their own firm-generated market sizing, data and estimates.

If your business is in a niche or small/specialty market, while this will be challenging, you will still be able to make top-down or bottom-up estimations of your market size and growth. To learn how to do this, take a look at FinModelLabs’ article on market sizing and how to estimate TAM, SAM and SOM for your startup.

5. The Competitive Landscape

What does the market in which you operate look like, in terms of your competitors and other comparable start-ups or organizations. Discuss how segmented your market is. Try culling this information from public sources such as market reports, and your own experience with the landscape as a founder.

For example, is it an oligopoly with only 3 or 4 major players occupying 80% or more of the market share? Or is it a very fragmented space, with thousands of independent players with no clear dominant presence?

Some questions to guide this section include:

- Who are your biggest competitors?

- What is their profile: are they local or global? Are they regionally present as well as locally?

- What is the extent of their business operations?

However, the most important question you’ll tackle here is – where do you fall, against your competitors and how do you position yourself?

Does your product/service offer something that other competitors don’t yet have? Are you operating in a saturated marketplace with existing similar offerings? If so, how does yours differentiate itself?

A straightforward way/hack to this is to present you and your competitors in a table format, and list all the common shared characteristics. For example, do they all have similar price points; are their SaaS solutions similarly structured (such as, subscription models)?

6. Business Model Examination

This is where you discuss how your product works, and how you built a business out of it. You’ve set the stage by discussing the problem you seek to address, then the solution you have targeted, and the competitive landscape you are operating in. Now, it’s about what your company and approach specifically brings, and this is what investors will look for.

There are two key matters to be explained:

- How your product works – i.e., is your SaaS product desktop only, or does it have a mobile application? Who is it for (can any user who downloads it use it – such as WhatsApp or Slack – or is it only for Comptroller and CFO)?

- How your pricing model works – what is the specific pricing model for your business: per user, flat tiered, etc? This will give investors an idea of how your business runs and how it can potentially scale.

7. Marketing Plan and Strategy

In this section, go through your customer acquisition strategy. How do you plan to attract and ultimately convert visitors to customers?

Your strategy will ultimately be determined by the nature of your business. Whether you are selling to B2B customers or a B2C product, will determine whether you deploy inbound or outbound acquisition strategies, or both.

Inbound and Outbound Acquisitions refer to distinct customer acquisition styles and strategies.

Inbound Acquisition pertains to when customers arrive at your landing page, either through paid (paid ads i.e. Google Ads) or organic (i.e. content, SEO) methods. And when visitors arrive, you convert them into customers. Often, this is most common for B2C SaaS businesses.

Outbound Acquisition means you are acquiring customers with the effort of a sales team, who reaches out to potential customers via email, mobile or other such sales efforts. Often, this is common for B2B SaaS businesses

For more information about customer acquisition strategy types, read our article about marketing strategies.After explaining your business’ acquisition strategy, with detail on tools (such as, which platform for paid ads, and what techniques your sales team uses), try to mention the following metrics:

- Average Customer Acquisition Cost (CAC) (but only if there is already recurring existing traction)

- The number of people on your sales team

- Average monthly customers closed by sales team

- Monthly boosted/paid ads, in budget

8. Timeline and Map

A timeline and map informs your investors about the direction you are going, and how your product and business aim to evolve. This can be done in a high-level manner (such as outlining your long term strategy), or have a breakdown in detail (such as, a pipeline of near-future milestones to be achieved).

Investors want to see an idea of what the future of the business and product look like, because they will be investing in that just as much as the current iteration. So, if the minimal viable product (MVP) you have currently has a limited range, actively speak about and include your future plans, so that investors can understand – and fund – your vision. Especially if you plan on serving a much larger customer base in the future.

Focus on the broader picture here rather than technical nuance. Rather than talk about, for example, a messaging feature in great technical detail (which is better saved for you technical/engineering team), discuss the opportunities for growth and entering new markets that it will confer, instead.

9.Your Team

In this section, discuss the organization of your company. How is it set up? What are the different teams, and who is in charge of each one? Who do the leads report to? This is to give your investors a general understanding of the ‘organogram’ of your business.

Focus on the people who make up your company, in detail (not just the co-founding or management). That being said, it would be best to keep information succinct. Biographies should be kept to a minimum, and only for the key (co-founders and management) staff. A maximum of 5-7 lines per team member is a reliable benchmark, and only what is relevant: name, position, years of experience and/or previous work experience.

If you have advisors (such as angel investors with significant experience) who play a part in the strategy advisory and direction of your company, they should also be included here, with the same level of detail as for the management team. The reason for this is that investors and interested parties invest just as much in the people, as in the business and service itself. If you can show in your SaaS business plan that you have a solid key management team, but also that you have industry-proven experts with known track records, these are green flags for your audience. And a strong selling point.

Note: if relevant, add clickable links to the respective Linkedin profiles for ease of reference for investors and to save space.

9. Financial Plan

We’ve reached the final section, and one of great importance. Investors are financially savvy, so this aspect is of key importance to them, as well as your team and your product/business. Unfortunately, many startups overlook the importance of the SaaS financial model in their SaaS business plan – don’t be one of them!

No matter how compelling your idea, as aforementioned – investors are financially literate and minded individuals. Their key driver and motivation will be on the returns your business can ultimately generate, hence why they will invest. They will look for and scrutinize the financial statements of your business as the basis of the expected financial performance.

Do not expect investors to accept ambiguity in this regard, or to weigh in as advisors on what direction or materials you should provide. As the founder or CEO of your company, you need to know your company’s direction and have it be reflected, financially.As a rule of thumb, the more advanced your company and the funding round, then the more granularity should be included. Pre-seed funding can expect to keep it to half a page/one slide, but for seed and Series A, it is more appropriate to have up to two pages/two slides.

In terms of key SaaS metrics to include in the SaaS financial model, some would be:

- Churn rate

- Monthly Recurring Revenue (MRR)

- Average Revenue Per User (ARPU) and Average Revenue Per Paying User (ARPPU)

- Lifetime Value (LTV) and Customer Acquisition Cost (CAC)

10. Publish!

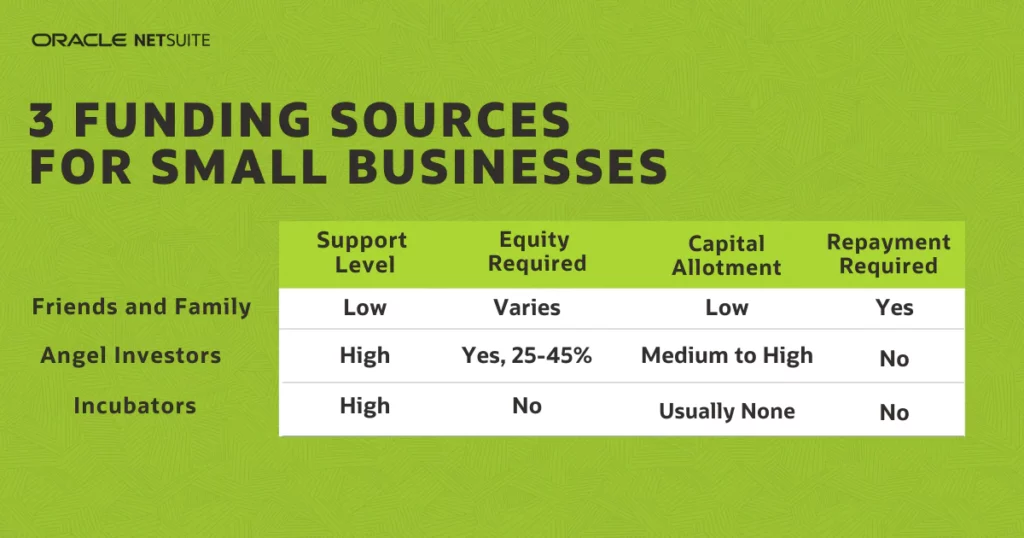

Finally and possibly the most important step is to get the plan in front of the right people. This is a topic that deserves an entire blog on its own as there are several routes to accomplish this. Below is a summary of the most common avenues that you can take to get your business plan out there:

- Friends and Family

- Online directories such as Gust

- Angel Investor directories such as Crunchbase

- Pitch Competitions & Incubators

- Crowdfunding platforms such as Kickstarter

If you have further questions feel free to schedule a free 5 minute CPA call with one of your CPA who specialize in helping startups obtain capital.

Comments