Do Independent Contractors Qualify for QBI?

What is Qualified Business Income?

“QBI” is short for “Qualified Business Income.” The term matters for thousands of businesses and freelancers because the 2017 Tax Cuts and Jobs Act allows non-corporate taxpayers to take a 20% deduction from their taxable business income if they qualify, which begs the question; do independent contractors qualify for qbi?

This deduction is sometimes called the QBI deduction or the 199A deduction, after the section of the Tax Cuts and Jobs Act that created the deduction. The deduction will be available at least until 2025, unless Congress extends it beyond that date.

When you are working as a small business, that can mean that you will not have to pay taxes on 20% of your qualifying income—which can be a huge advantage in many situations.

To get the 20% deduction, you must have qualified business income. The deduction only applies to that particular type of income. The term is defined in the Tax Cuts and Jobs Act, but it is actually relatively straightforward, at least at first blush.

Qualified business income is the ordinary income of your business minus the ordinary deductions that you would have. In essence, then, it is the net income from your business.

Can Independent Contractors Claim QBI?

Although many freelancers or independent contractors do not think of themselves as “businesses,” they really are. Most freelancers operate a sole proprietorship, which is also the most common type of business structure in the United States. The QBI deduction applies to freelancers, just like it would apply to anyone else who operates a sole proprietorship.

If you are getting a 1099-MISC for your work, then you are likely an independent contractor or freelancer. Thankfully, the qualified business deduction is available for contractors like you.

Which Types of Businesses Qualify for the 199A Deduction?

There are some restrictions on which companies can claim this deduction. Specifically, C-corporations do not have the benefit of the 199A deduction. Instead, it only applies to:

- Sole proprietorships (including freelancers and independent contractors)

- Some limited liability companies (LLCs)

- S-corporations

- Partnerships

Trusts and estates can also take advantage of this deduction, as well.

You also cannot get the QBI deduction for any wages that you earn as an employee.

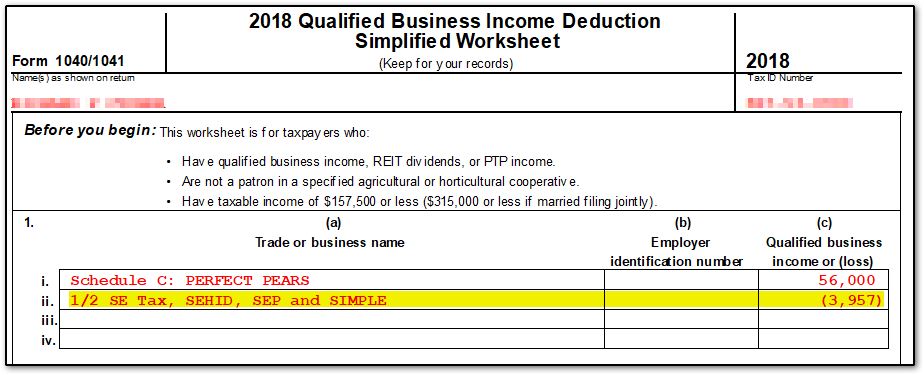

In general, if you are using the following forms on your taxes, you likely can claim some version of the QBI deduction.

- Schedule C

- S-corp or partnership K-1

- Schedule E

The deduction is designed to provide some tax relief to small businesses, but there are some additional limitations as well.

What Is NOT Qualified Business Income?

Some types of income specifically do not fall under the definition set out in Section 199A. While many of these will not apply to independent contractors, they are worth noting, just in case your freelancing or contracting business gets income from these sources.

1. Some compensation paid to partners and shareholders

If you are part of an S-corporation or a partnership, you cannot include any compensation paid to partners or shareholders. However, if you are part of a partnership, this limitation only applies to the guaranteed payments of the partnership.

In general, the rule of thumb is that if you received W-2 wages or guaranteed payments, then the QBI deduction will not apply to that income.

2. Foreign income

Income that you earn from operating your business outside of the United States does not qualify for the QBI deduction. This restriction may be relevant for ex-pats who are working as freelancers outside of the U.S.

3. Investment income

If you get investment income as part of your business, then you cannot include those funds in the QBI deduction. The most common examples include:

- Short-term or long-term capital gains

- Dividend income

- Interest income

This income is not “earned,” so it is excluded from the definition of qualified business income.

What Are the Income Limitations of the 199A Deduction?

The QBI deduction is also limited by income, which is sometimes referred to as the “threshold level.” That is, if your taxable income is too high, then your deduction may begin to phase out. It starts the phase-out at $157,500 for single people and $315,000 for individuals.

The deduction will be zero if your income is over $207,500 as a single person or $415,000 as a married person.

As a freelancer or independent contractor, you should consider your income from all sources to compute these limitations. For example, if you have a normal W-2 job and you do freelance work on the side, then you should consider your W-2 income and your freelance income to determine whether your deduction will start to phase out.

If your total income is below the numbers listed above, then you do not have to worry about the phase-out.

Are There Industry Limitations for the QBI Deduction?

Businesses from certain industries also cannot get the QBI deduction, but only if their income is over the threshold level.

In general, “professional services” firms will not be able to take advantage of the 199A deduction. These businesses are referred to as a “Specified Service Trade or Business” or SSTB. Examples of companies that would fit this definition include:

- Doctors and other medical professionals

- Attorneys and law firms

- Accounting firms

- Actuarial science

- Financial services

- Financial consulting

- Athletics or health organizations

- Trading or investment management

There is also a “catch-all” restriction that does not allow businesses to take the deduction if they rely on the “reputation or skill of one or more employees.” Of course, this restriction is extremely vague—everyone relies on the skills of their employees to get work done. Nonetheless, it appears to limit higher-earning professional businesses in industries that may not have been specifically named. Real estate agents, for example, might fall into this “catch-all” category.

What If My Contracting Work Only Partly Comes from Professional Services or Investments?

There are certainly situations where only a portion of your income comes from professional services or investments. In those cases, you will not be completely barred from asserting the QBI deduction. Instead, you will divide out the sources of your income so that the 20% deduction only applies to income that properly qualifies.

However, you can only take advantage of this deduction is your gross receives for SSTB fall under a certain level. Specifically, if your SSTB income is 10% or less and your total gross receipts are under $25 million, then you can still take the full deduction. This scenario is called a “de minimus” exception to the SSTB restriction.

Let’s consider an example.

Imagine that you are a single person that runs a business that mainly does two things: You provide financial consulting services, and you sell books and white papers about tips and tricks for investing. You also have some investment income as well. You make $20,000 per year on consulting services and $190,000 per year from your book and white paper sales, less all of your business expenses. In total, then, your business makes roughly $210,000 in revenue.

In that type of situation, you are engaged in professional services that would otherwise disqualify your business from getting the discussion. You make a total of $210,000, which means you are above the threshold for a single person, and your QBI deduction will begin to phase out. However, you are not disqualified completely because over 90% of your income comes from white paper and book sales, rather than consulting services. That means that you can take the QBI deduction on the full amount of your income.

Other Deductions Under 199A

Section 199A also offers deductions for more than just contract payments. It also applies to:

- PTP: Qualified publicly traded partnership

- REIT: Real estate investment trust dividends

You can use the 199A deduction in combination with these other sources of income. That is, you can not only take 20% deduction on your QBI, but you can also take a 20% deduction on your PTP and REIT, as well.

However, this number must be the lesser of another calculation—20% of your taxable income computed before the QBI deduction, minus any net capital gains.

These limitations and other sources of income often do not apply to freelancers and independent contractors, but they might, depending on the nature of your business.

Are you Taking Full Advantage of the QBI Deduction?

Are you Taking Full Advantage of the QBI Deduction?

Freelancers and independent contractors will usually qualify to take the QBI deduction. However, some make the mistake of assuming that they have to have a separate legal business entity to use this deduction. Thankfully, that is not the case.

The Tax Cuts and Jobs Act was designed to give tax breaks to small businesses, like yours. You should be sure that you are taking full advantage of your 20% deduction by talking to a tax professional who knows the ins and outs of this deduction. Learn more about our tax prep services by requesting a free consultation or reviewing our FAQ Section.

Comments