How Much Does It Cost To Hire A CPA?

Nobody likes paying taxes, and if you run a business, you sure don’t want to pay more taxes than necessary. But it can seem like a balancing act trying to decide who should do your taxes. A mistake could mean giving the IRS thousands of dollars you could have put back into your business. It could even mean facing an audit! On the one hand, you want to maximize deductions and tax credits, but on the other hand, you don’t want to spend a fortune on tax preparation.

Nobody likes paying taxes, and if you run a business, you sure don’t want to pay more taxes than necessary. But it can seem like a balancing act trying to decide who should do your taxes. A mistake could mean giving the IRS thousands of dollars you could have put back into your business. It could even mean facing an audit! On the one hand, you want to maximize deductions and tax credits, but on the other hand, you don’t want to spend a fortune on tax preparation.

The safest course would seem to be to hire a CPA. But how much does it cost to hire a CPA? Can you or your bookkeeper handle your taxes just as well? What are your other options? Let’s talk about choosing the right tax preparation option according to the needs of your business.

Your Business Tax Needs:

To begin, determine the level of complexity of your taxes.

- Do you freelance? If so, do you do so just occasionally or does freelancing comprise a substantial part of your income?

- Are you a single member LLC or is your business structure more complicated such as a multiple member LLC or an S corporation?

- Or perhaps you have a C corporation, partnership or multiple member LLC with revenue in excess of a million dollars?

Next, you will want to determine how much money you are willing to spend. Remember though, that the better your tax preparer, the more likely you are to save on taxes.

Keep your needs in mind while we consider your options.

DIY Options:

If you are the sole owner of a small business or if you are a freelancer, you may consider doing your taxes yourself or having your on-site bookkeeper do them in order to save money. The most popular options in the DIY category are software and online products from TurboTax and H&R Block both of which offer live computer interaction with tax experts for an extra charge. DIY options are not suitable for larger companies such as C corporations or multi-member LLCs.

TurboTax Live Software

If you purchase the Live add-on available for some TurboTax packages, you can get the cost benefits of doing your taxes yourself but still have a CPA or an Enrolled Agent review them. (An enrolled agent is authorized to represent taxpayers in IRS proceedings after either passing a three-part comprehensive IRS test or by virtue of their experience as a former IRS employee.) You can also connect live via computer with a CPA or EA for tax advice.

TurboTax Live Self-Employed is the one you will want if you are a freelancer or are the sole owner of a small business. The cost is $200 for your federal taxes, and each state is additional.

H&R Block with Online Assist Software

H&R Block has many brick and mortar stores across the country, but it also offers various tax software packages that include Online Assist where you can get online support while you do your taxes and a review of your final forms from an undefined “tax expert.” Their website does not indicate if the tax expert is a CPA, an enrolled agent or some other type of tax professional.

You may want to consider one of these packages if you are the sole owner of a small business or are a freelancer:

- H&R Block Premium Online Assist is appropriate for freelancers or contractors with income under $5,000. It costs $159.99 not including the state package.

- H&R Block Self-Employed Online Assist is appropriate for freelancers and contractors who make over $5,000 per year and small business owners. It costs for the federal tax package, and the state package is extra.

Tax Preparation Franchises:

Tax Preparation Franchises:

Freelancers or very small businesses who are not comfortable using DIY software packages even with live computer assistance may want to consider a tax preparation franchise. If your taxes are more complex, such as those for multi-person LLCs or any kind of corporation, don’t expect to get the level of service you need at a franchise to take advantage of all deductions and credits. They are focused on individuals and very small businesses. As mentioned, in addition to software, H&R Block is a popular tax preparation company that has physical locations nationally. Starting price for a simple business tax return at H&R Block is $350.

CPA Firms:

“CPA” stands for Certified Public Accountant (CPA). CPAs are board-certified professional accountants who have demonstrated skills and usually years of experience.

Do I Need a CPA to Prepare My Taxes?

There is little doubt that the average cost of tax preparation by a CPA is going to be more expensive than other options of tax preparation. But depending on the complexity of your returns, a CPA may very well save you money in the long run. It takes no special talent to use software and complete each blank space with numbers, but CPAs have the education, training and experience to analyze your business as a whole and advise you on the steps you can take to save on your taxes. They can often save you thousands of dollars or even millions in some situations.

Larger companies will want their CPA to review their books and advise them of changing situations throughout the year not just at tax time. But CPAs are particularly valuable for getting you the maximum amount for deductions and tax credits on your returns.

How Much Does it Cost to Hire a CPA?

You want the best for your business of course, and many people ask, “How much does it cost to hire a CPA?” The answer, not surprisingly, is “It depends.” Hourly rates and fixed fee rates for the same task can vary wildly. According to CostOwl.com, “CPAs are at the top of the pay scale (of tax professionals), commanding $150 to $250 per hour in most cases. In major cities, however, a tax accounting firm’s top talent might command up to $500 per hour.”

Some factors that determine costs include

- Complexity of the task: If you have a simple one-owner business, your tax return is going to cost much less than that for a large corporation.

- Size and prestige of the firm: Some CPAs work out of mom and pop type shops while others work for elite, full-service firms.

- Region: The region where they are located affects CPA rates. Expect to pay more in New York City and Los Angeles than you would in Tulsa.

- Experience: As with any professional, CPAs consider their experience and skill level when setting their rates.

Most accountants and tax professional bill by the hour (57% according to an Intuit survey) but 54% bill flat fee for corporate tax preparations services. The National Society of Accountants reported an average CPA tax preparation fee of $481 for a Form 1040 with state return, Schedule A, and Schedule C. Bear in mind, that is the simplest possible business return. Some C corporations and multi-member LLCs have extremely complex tax returns that cost thousands. And if you are looking for CPA advice throughout the year, you may pay anywhere from five to six figures.

Virtual CPA Platforms:

Virtual CPA Platforms:

If you don’t have a multi-million dollar or multi-billion dollar business, you may want the security of CPA tax preparation and e year-round tax advice but without paying thousands to a CPA firm. There is a way. A good virtual CPA platform can offer you a one-on-one, continuing relationship with an experienced CPA without the high price tag and without the drudgery and risk of using a DIY software package. Look for

- Customized services and pricing for tax preparation and other services

- The availability of coaching throughout the year

- Detailed analysis of your business’s tax needs

- Ability to handle all types of businesses from those with side gigs to C corporations.

Unlike the virtual bookkeeping market which is highly competitive and saturated, the market for virtual tax prep firms is under served with only a few startups embracing the fully virtual tax prep business model:

- Taxhub – a virtual tax prep firm that specialize in freelancers and Solopreneurs

- Visor – a virtual tax prep firm startup specializing in employees with stock options and RSU’s

- Taxfyle – a virtual CPA market place that matches individual filers with CPA’s

What’s the Best Choice for Your Business?

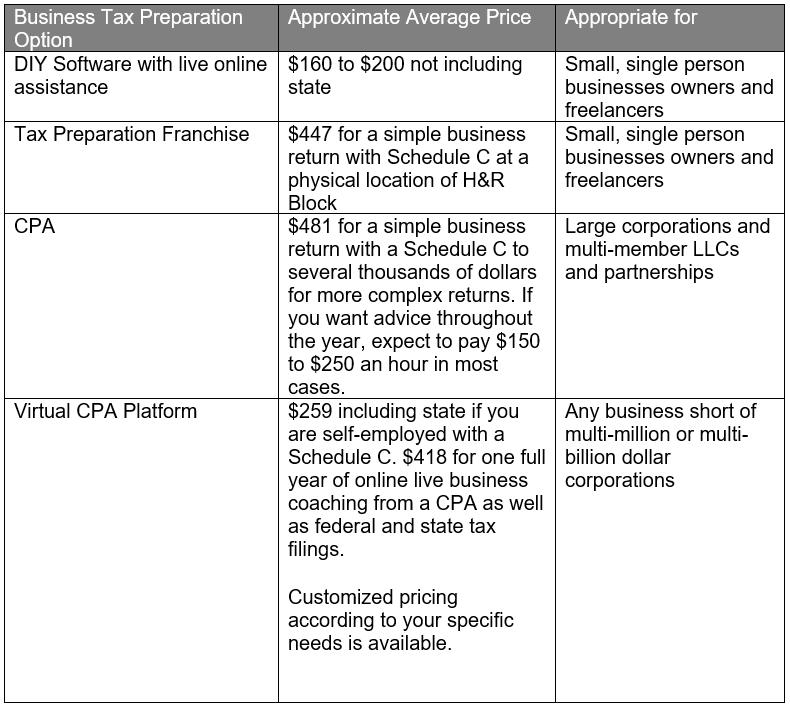

This table gives you the focus and how much it cost to hire a CPA for each option.

If you are running a multi-million or multi-billion dollar corporation, you should probably hire a large, full-service CPA firm. But if you aren’t yet running a business on par with Amazon, a virtual CPA platform gives you the best of all worlds no matter what your business structure. You have the convenience, face-to-face interaction and security of dealing directly with an experienced, reliable CPA but without the sometimes prohibitive cost of a CPA. For more information about how much it cost to hire a CPA feel free to schedule a free 5 minute CPA call here

If you are running a multi-million or multi-billion dollar corporation, you should probably hire a large, full-service CPA firm. But if you aren’t yet running a business on par with Amazon, a virtual CPA platform gives you the best of all worlds no matter what your business structure. You have the convenience, face-to-face interaction and security of dealing directly with an experienced, reliable CPA but without the sometimes prohibitive cost of a CPA. For more information about how much it cost to hire a CPA feel free to schedule a free 5 minute CPA call here

Comments