Is Rental Income Passive or Earned Income?

If you are one of the countless landlords in the United States, who cumulatively own over 48.5 million rental units in the nation, you probably asked if rental income is passive or earned income at some point. Depending on your experience, however, you might have some lingering questions regarding the proper way to report rental revenues, especially if you are just getting started and have yet to purchase a property.

Unfortunately, as with many other provisions of the seemingly endless tax code, the Internal Revenue Service, or the IRS, has not made it easy on those who rent residential properties. This is because it is impossible to answer this question with a simple answer. Instead, whether the rental income is active or passive is going to depend on some factors that you must get familiar with. The most important one, however, is the level of involvement that you had with the renting process.

Passive Versus Earned Rental Income

Although there are many ways to divide income, the most common one is to split it into active and passive. Both of those categories are accompanied by a different set of tax rules, regardless of the source of income. For instance, whether you have real estate investments such as rental properties or a rich stock portfolio, the passive deduction limitations will apply uniformly.

Active income is whatever you earn from actual work or material participation. Examples would include your W-2 wages, cash tips, sales commissions, or profits from a small business. The common denominator for each of those categories is that you provided a good or service in exchange for consideration, which is the payment.

Passive income, on the other hand, is money that you receive absent tangible action. It arises as a byproduct of either immaterial participation or inactivity within the venture. The sources that come to mind here could be range from rental activity to limited partnership or security investments. Thus, you are letting your money grow or receiving a return on something that does not require active involvement.

Rules That Apply to Rental Activity

Technically speaking, rental properties would generally fall under the passive activity rules as most taxpayers do this in addition to their main job. So, it is a form of a side hustle that brings in a certain amount of supplemental revenues. Things get a bit more complicated once individuals like professional real estate dealers enter the equation, however.

The reason why is that real estate dealers focus all of their attention on making money from the rental properties. That means that they are in the business of leasing units and collecting rent payments from their customers. Since such a track record is the epitome of active participation, their rental income will be earned income.

To sidestep the confusion related to when one becomes an active or a passive owner, the IRS offered a detailed overview of the requirements. Since the default status is passive, satisfying the following conditions would upgrade one to the status of an active owner:

- You owned 10% or more of the property.

- You made management, tenant selection, and repair decisions.

- You actively approved or denied expenditures related to the property and remained in charge of the finances.

If all of the above is true, the IRS will give you the benefit of a doubt and classify you as an active owner. To fully comprehend and compare the alternatives, let us look into the most important tax consequences of passive and active rental income.

Laws Related to the Number of Days Rented

When your revenues are passive, you will need to look into another set of laws before you start deducting any expenses related to the property. Since taking out an entire year’s worth of expenses would be unfair if you also used the property at some point, you must allocate those costs.

So, if you rented the property for a total of six months and used it yourself during the remaining six months, only half of the overhead costs would be deductible. This arises as a consequence of the timeless accounting rule known as the “matching” principle. In other words, your expenses must match your revenues.

Hence why you can only deduct something when there was a renter who utilized your property and you had to pay for items that make the home available for their use. If you purchase a TV so that you can watch sports, for example, the IRS will almost effortlessly deny your deduction claim. In case that the TV will be used for the benefit of the renter, you would get to deduct it as a justified expense.

The Magic Number 14

There are a few exceptions where you do not even need to bother any rental income whether it be passive or earned income. The most obvious takes place under the so-called rule of 14. If you have a property that you rented to others for less than 14 days in the year, the money that you made does not need to be accounted for. The IRS sees 14 days as the bare minimum that shows how you have the intention of facilitating passive earnings or getting actively involved with the property.

Tax Consequences of Passive Rental Income

As with any other type of passive income, you are not allowed to take a loss on the activity. Instead, you must wait to earn some money from that source before you make the deduction. Fortunately, you can carry those losses forward for as long as necessary. If you are going through an extremely rough stage that is characterized by enormous passive losses, remember that all those loses will morph into the much-needed deductions once your venture becomes profitable again.

Tax Consequences of Active Rental Income

Active rental income applies to taxpayers who have a business centered around leasing properties. In translation, it applies to real estate dealers that focus their careers in this industry. For them, the rules are practically identical to other types of active earnings where they can deduct all business-related expenses on Schedule C. If applicable, it also means that you will need to pay the self-employment tax and take the necessary adjustments as well.

Of course, not everything related to active participation is negative. One of the most advantageous aspects of active earnings is that you can take out $25,000 of your losses from your gross earnings across all sources. For instance, if your current, post-tax earning level for the year is $50,000 and you incur a $60,000 loss on a property that you manage and control personally, you would have to pay tax on only $35,000. Someone who has a $60,000 passive loss would need to carry it forward until there are some passive gains that they can offset. The fact that it transfers between different types of income for active earners, though, is easily the most important benefit of their status.

The Difference Between the Numbers

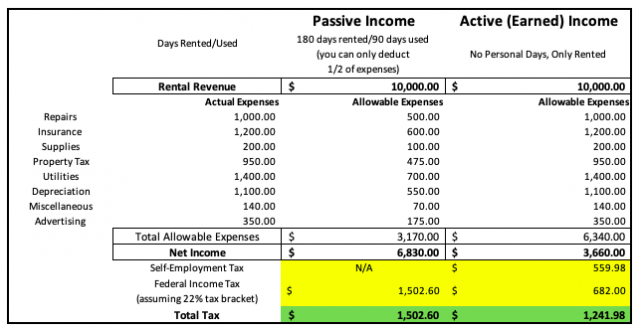

To see a good depiction of how the taxation will differ, consider the following table. It shows the same taxpayer in two situations; the first one classifies them as a passive rental property owner while the second one flips the script and turns them into an active participant. Note the differences between the amounts that they get to take as deductions and how much total tax they pay.

As shown, when they are a passive rental property owner, they have to allocate their costs between the days that they used the property personally and days they rented it. Active participants do not have to make such allocations because their entire business revolves around renting, thus, they do not utilize the organization’s asset personally. Nonetheless, the active participant still voided a lot of their savings from those deductions by having to pay the self-employment tax.

Is One Better Than the Other?

It is borderline impossible to determine which taxation status is better. Looking at the aforementioned example, one could say that the active participant saved some money on taxes. Does this mean that they are in a better position, though? Not necessarily. If the expenses were a lot lower, the discrepancy would not be as high. Similarly, the more money that the active property owners make, the more self-employment tax they must pay, which is 15.3% of the income that they do not get to keep.

One thing that is easy to confirm, however, is that passive participants are a lot more common in the U.S. as the number of real estate dealers is relatively low. Still, there are too many variables in the equation to make an accurate prediction. Some situations will be more favorable to those who do not have material participation while some will be the exact opposite of that.

As long as you follow the guidelines and report your income accurately, which means learning when your rental income is passive and when it is earned income, you should not run into any issues with the IRS. For further assistance, get a free consultation or get pricing on our virtual tax prep services.

Comments