Royalty Income Tax Rate for 2020

If you are a creator, property owner, or a right holder who earns passive income, you may need to start researching the royalty income tax rate for 2020. As one of the aforementioned, you can receive compensation in exchange for the fair use of your assets. Note, however, that the use of the term “asset” is quite loose as anything from a music track to land could qualify. Thus, the nature of the thing that you own does not necessarily matter.

How Much Tax Should You Generally Expect to Pay on Royalty Income in 2020?

All royalties are subject to ordinary tax rates, and they depend on the tax bracket that you are in. For instance, if you earn $100,000 in total and need to pay tax on roughly $80,000 after all adjustments and deductions, the IRS will levy a 22% tax on your royalty income for 2020. If your earnings from copyrights, patents, or other types of rights put you just above the threshold and you enter a higher tax bracket, you must pay the higher rate. This is because the tax calculation revolves around the marginal percentage, which is the rate applied to the next dollar that you make.

What Is Royalty Income?

Royalty income represents all the payments that you receive from someone else using something that is rightfully yours. It is generally a temporary arrangement where the other party gets to enjoy the benefits of your work. Since you are not directly related to their venture, although you still get to take a portion of their profits, your percentages will fall on the low-end. Some of the most common examples of royalty income come from intangibles such as copyrights and patents as well as physical assets such as properties.

– Copyrights

If you ever had a chance to analyze the technical side of the entertainment industry, you probably ran into something known as “copyrights.” As per the government’s official website, copyright is a form of intellectual property given to the person who holds the authorship over some medium. This could include anything from unpublished poems to various types of videos. The law is based on the Constitution of the United States, and the historical precedent is that courts have not been lenient when deciding cases that deal with copyright infringement.

– Patents

Patents are relatively similar to copyrights in that they are also intangible assets that grant creators rights to protect their inventions from fraudulent copying. The main difference, however, is the fact that patents deal with physical creations that include tools, assets, products, or any form of tangible goods that someone designed or manufactured. Also, while copyrights last 70 years, patents are only eligible for 20-year terms.

– Oil and Gas

Finally, there is a source of royalty income that is statistically much more likely to affect you than any others. The oil and gas royalties that arise from mineral rights and mining are a lot more common in the U.S. than any of the other alternatives. The growth of the United States as one of the world’s leading powers when it comes to petroleum has facilitated this situation, and even though the industry has recently been struggling, it is still incredibly prosperous.

The way that the concept functions is based on someone allowing a third party to use their mineral rights and extract minerals from their property. Since the third party will utilize their land to do so, they must pay them for whatever they take out of it. While the value of the royalty is subject to negotiation, most contracts set it around one-eighth of the entire amount of oil and gas produced. Property owners who have extremely rich land can increase that value far above one-eighth, though.

As a property owner who earns royalties from mineral rights, you get to deduct depletion allowance. This goes back to the timeless notion that all revenues must match expenses that accompany them in a certain period. So, since someone is coming in and drilling into your property to extract minerals from it, the value of the land will decrease. Unlike non-fixed assets, however, long-term fixtures like these do not depreciate, they deplete their worth.

So, the IRS will let you take a depletion allowance amounting to 15% of the revenues that you earned. Keep in mind that there are two limits that you have to apply when calculating this deduction:

- You cannot have a net royalty loss, thus, your depletion allowance cannot exceed the income generated from the property.

- Your total depletion allowance cannot be more than 65% of the entirety of your income from all activities and sources.

How Do You Report Royalty Income Taxes?

All of your royalty income taxes for 2020 will go on Schedule E of Form 1040. It is a two-page form titled “Supplemental Income and Loss” where anything from real estate and trusts to partnership and S corporation earnings will go. Since there is not an overwhelming number of Americans who make money from royalties, there is no specific schedule made for them.

After receiving your 1099-MISC, which will be discussed in more depth shortly, you will report the royalty income on line 4, column A, B, C, or any combination of those, of your Schedule E. Each column represents the property you are reporting, and line 1b shows the type of that property. The reason why the Internal Revenue Service, or the IRS, limits each Schedule E to three properties is due to their two-fold strategy. First, it helps them keep things simple and saves time that their agents must spend on each form. More importantly, however, three properties would be a relatively decent estimate of how many such assets someone who is a non-active royalty earner would have.

If you happen to have a lot more than three properties, the IRS will want you to consider if you are a sole-proprietor whose main course of business revolves around mineral rights. If you just happen to own quite a few properties but are not a sole proprietor, you can just send as many Schedule E forms as you need.

Schedule E Example

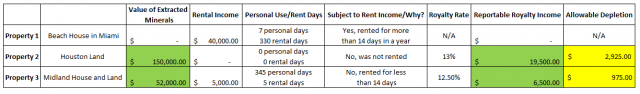

To understand how you would go about filling out a typical Schedule E, consider the following summary that shows a typical annual activity for a taxpayer who owns multiple properties.

As depicted in the table, the person owns three different properties that are based in Florida and Texas. While some of them were rent-based, we will focus on mineral-related activity. As shown for properties two and three, the taxpayer gave their mineral rights to someone as there is a substantial amount of value in extracted minerals. Given their 13- and 12.5-percent royalty rate, they subsequently earned a royalty of $19,500 for property two and $6,500 for property three.

How Do You Account for Your Royalties?

As long as you are not a sole-proprietor who lives off the intangible rights, you will receive a form titled “1099-MISC” that shows your gross non-employee, miscellaneous earnings for the year. For example, if you own a property and let someone drill and extract oil from it, you will have miscellaneous income from the royalty. If you invest in a drill and try to extract those minerals yourself, you are now in the petroleum business and must pay some additional taxes.

Should You Worry About Self-Employment Taxes?

The IRS defines royalty income as any earnings made from sharing the rights to something not done as a part of regular business activity. The caveat “not done as a part of business activity” is crucial because it immediately excludes those who have a specific focus on working in this field. Consider, for instance, a person who has 20 properties that they use to sell mineral rights and generate royalty income.

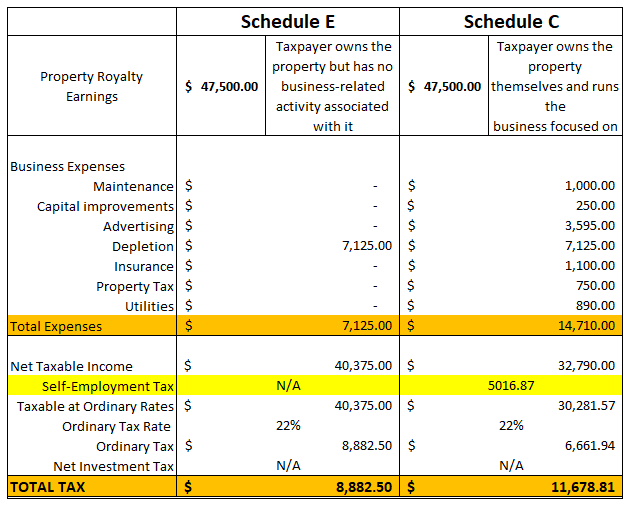

At that point, they most likely become a sole proprietor whose primary business activity is investing in properties to generate passive income. Therefore, whatever they earn will be subject to self-employment tax and, potentially, net investment tax. If that is the case, you will not fill out Schedule E but Schedule C that shows net profit or loss from your business. Doing so will allow you to deduct a lot more than just depletion as any money, within reason, that you invest in your properties will be deemed an acceptable business expense. The following image showcases the difference between taxable income that someone will have when their properties generate royalties versus business profits.

Keep Track of All Paperwork and Seek Professional Help

The easiest way to accurately calculate your royalty income tax for 2020 is to keep outstanding track of all transactions and earnings. Even though you should expect to receive 1099-MISC from the operators who utilize your patents, copyrights, or properties, they may fail to fulfill their duty and send you one. This is when you must go back to your data and calculate the net taxable earnings. If you consider the situation to be overly complex or tedious, remember that you can hire professional help who can resolve your matter much faster and more efficiently. That way, the odds of you submitting a correct return are much higher. Alternatively, click on the following links to get a free consultation or get pricing on our virtual tax prep services.

Comments